Thiago Rodrigues Maia

Fusões e Aquisições Infraestrutura e Financiamento de Projetos Mineração Private Equity e Venture Capital Societário

11 3356 2006 trmaia@demarest.com.br São Paulo

Sócio da área de Fusões e Aquisições do Demarest, Thiago Rodrigues Maia é mestre pela Northwestern University School of Law (EUA). Possui forte atuação em aquisições e alienações de participações societárias, transações de private equity e joint ventures comerciais. Dentre seus principais clientes estão grandes empresas, fundos de private equity e empresas do setor de mineração. Membro da New York State Bar Association, Thiago é também recomendado por sua prática em alguns dos rankings mais relevantes do País e do mundo.

- Assessorou Darwin, insurtech brasileira, na captação de sua rodada de investimentos Pre-Series A no valor total de US$ 8 milhões.

- Assessorou a Cegroup Participações e Terloc – Terminal Logistico Cesari, no processo de aquisição da totalidade das quotas detidas pelo Vendedor, no capital social da Conport Afretamentos Marítimos O.K., sociedade limitada, especializada em operações portuárias.

- Assessorou a Ambar Tech Participações em sua rodada de investimentos série C liderada pelo FIP Echo Capital e FIP Oria Tech III Master.

- Assessorou a HB Saúde na venda estruturada de participação societária no seu capital para a HapVida.

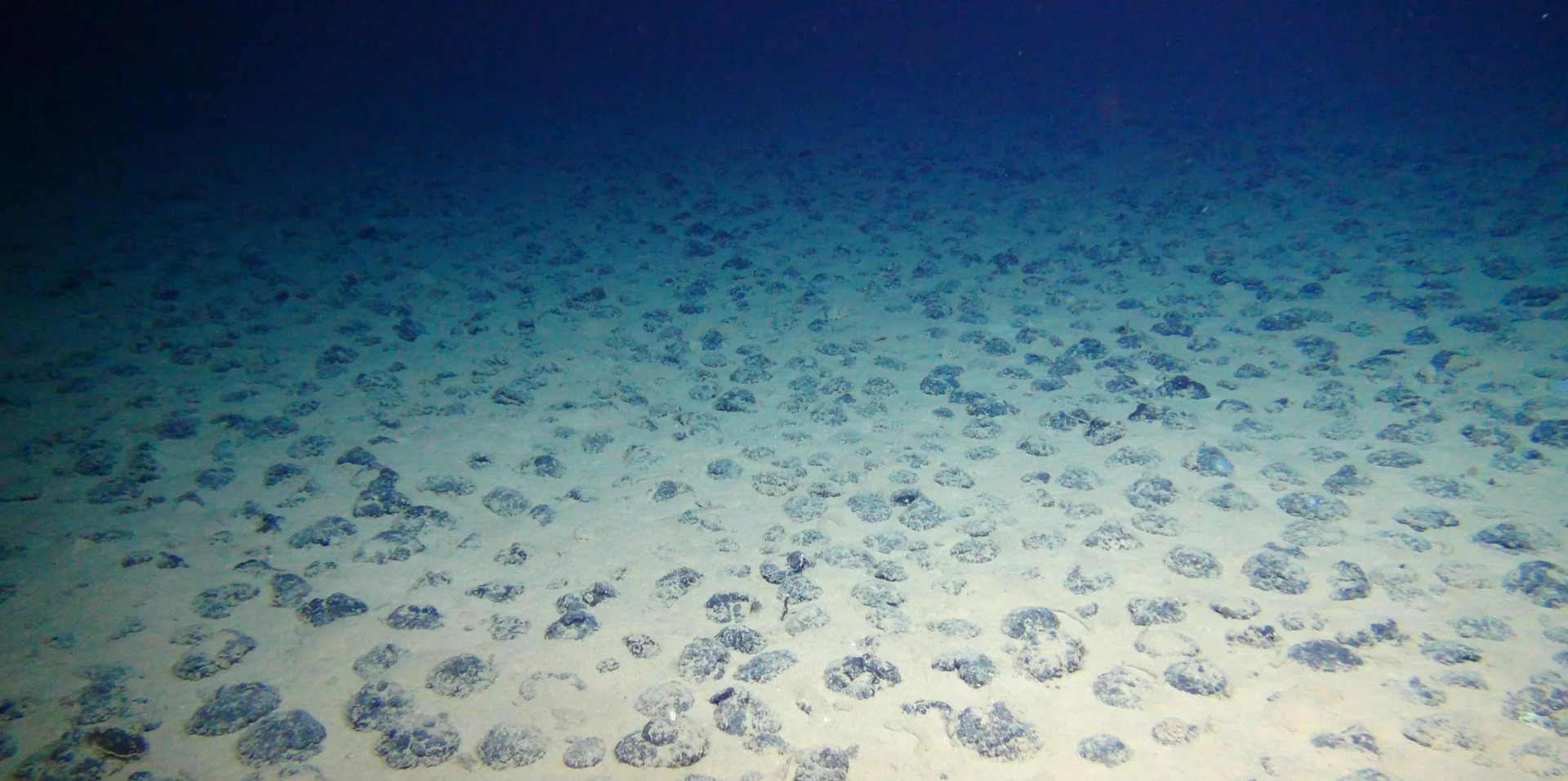

- Assessorou Imerys na aquisição de certos direitos minerários e plantas de beneficiamento nos estados do Espírito Santo e São Paulo.

- LL.M. (com honras) pela Northwestern University School of Law, Estados Unidos, (2008)

- Certificado em Administração de Empresas pela Kellogg Graduate School of Management, Estados Unidos (2008)

- Bacharelado em Direito pela Pontifícia Universidade Católica do Rio de Janeiro (PUC-Rio), Rio de Janeiro, Brasil (2002)

- Membro da New York State Bar Association

- Português e Inglês