This newsletter is for informative purposes only and does not constitute legal advice for any specific operation or business. For more information, please contact our legal team.

Insights > Newsletters

Newsletters

Energy and Natural Resources Newsletter | May and June 2025

July 18th, 2025

In order to keep our clients informed about the current landscape of the main energy and natural resources sectors in Brazil, we have prepared the Energy Newsletter, a monthly bulletin with the main news of the energy market.

This information channel is the result of the collaboration between our “Oil & Gas” and “Energy” teams.

The newsletter was designed within the context of the energy transition that is being targeted in Brazil, and drafted as a complete source of information about the dynamic Brazilian energy market within the oil, natural gas, electricity and renewable energy sectors.

Enjoy reading!

Oil and Gas

HIGHLIGHTS

ANP publishes new versions of OPP tender and contracts

The key amendments to the instruments are listed as follows:

- Adjustments to local content guidelines, in compliance with CNPE Resolution 11/2023 and Law 15,075/2024;

- Implementation of ANP Resolution 969/2024, which regulates bids under the concession and production sharing regimes;

- Update of guarantee insurance models arising from Public Consultation and Hearing No. 01/2024;

- Relaxation of the Minimum Exploratory Program (“PEM”), which no longer requires the drilling of an exploratory well for all areas, and now provides for the possibility of carrying out 3D seismic activities and 3D seismic reprocessing;

- Exemption from payment of the participation fee and the data sample;

- Possibility for bidders without a declaration of interest to submit a bid guarantee (they can participate in the public session in collaboration with a company that has submitted a declaration of interest);

- Flexibility as regards the presentation of the bid guarantee, which may be delivered in physical or digital format;

- Definition of deadlines for the OPP cycle, with a minimum length of 120 days and a maximum length of 180 days, between the approval of the declaration of interest and the public session;

- Change in the order of the stages, implementing the reversal of phases, with the qualification of the winning bidders only, which will occur after the public session;

- Improvements in “Annex VI – Procedures for Calculating Oil Cost and Surplus” and “Annex IX – Consortium Regulations”; and

- Inclusion of provisions encouraging practices towards reducing greenhouse gas emissions.

As informed by the ANP, 13 blocks will be available for offer in the Pre-Salt Polygon, 6 in the Campos Basin (Citrino, Itaimbezinho, Jaspe, Larimar, Ônix, Turmalina), and 7 in the Santos Basin (Ágata, Amazonita, Ametista, Esmeralda, Jade, Safira Leste, Safira Oeste).

ANP approves consultation and public hearing to distinguish gas transport pipelines

On May 29, 2025, the ANP’s Board of Directors approved a public consultation and hearing to discuss a draft resolution that will establish the technical criteria for distinguishing gas transport pipelines (Public Consultation and Hearing No. 01/2025).

The ANP’s purpose is to regulate the provisions of item VI of the caput of art. 7 of Law No. 14,134/2021 (“Gas Law”), regulated by Decree No. 10,712, of 2021. The Gas Law established that the ANP is responsible for defining the criteria for distinguishing gas transport pipelines, based on technical characteristics such as diameter, pressure, and length.

The public consultation will be open from June 05 to July 21, 2025, totaling 45 days, and the public hearing will take place on August 13, 2025.

Prior consultation approved on regulations for distributing and reselling aviation fuels

On May 29, 2025, the ANP’s Board of Directors approved a prior consultation for the Regulatory Impact Analysis (“AIR”) report addressing the revision of the resolutions on the distribution and resale of aviation fuels (ANP Resolutions No. 935/2023 and No. 936/2023, respectively).

According to the ANP, the aim of the review is to streamline the regulations for the distribution and resale operations of:

- Aviation kerosene (Jet A, Jet A-1 and JET C types);

- Alternative aviation kerosene (alternative JET);

- Aviation gasoline; and

- Ethanol-hydrated fuel.

In addition, the review seeks to help reduce the operating costs of Brazilian airlines and increase competition in the distribution and supply of aviation fuels, while preserving the safety and quality levels of current operations.

During the study to revise the regulations, the ANP found that business models are not yet regularly applied in Brazil. One of the proposed measures is to authorize the operation of aviation fuel storage facilities located in Aircraft Refueling Parks (“PAA”) at airports. The proposals also include provisions for sharing facilities and self-supply operations, in which airlines undertake to refuel their own aircraft.

In addition, storage facilities in PAAs could now be operated by logistics operators (agents that provide handling services and do not sell products).

ANP approves requirements for Minimum Exploratory Program outside the concession area

On June 12, 2025, the board of the Brazilian National Agency of Petroleum, Natural Gas and Biofuels (“ANP”) approved a resolution establishing requirements and procedures fulfilling the Minimum Exploratory Program (“PEM”) outside the boundaries of the area contracted initially under the concession regime.

The measure applies to concession contracts in the exploration phase and aims to improve the performance of the segment by stimulating exploratory activities.

The new resolution states that in order to comply with the PEM outside the original contractual area the operator must submit a request to the ANP indicating the originating contract and the receiving area where the Work Units (“UTs,” in Portuguese) will be executed. The operator may define the amount of UTS provided that the operators of both the originating and receiving contracts are the same in the case of a contracted area. Once the activities are completed in the receiving area, the UTs will be deducted from the PEM stipulated in the original contract.

The resolution also defines the parameters for complying with the PEM in areas without a contractual bond for exploration and production, while prohibiting the use of this mechanism in pre-salt and strategic areas.

ANP to hold public consultation and hearing on updating minimum capital requirement for regulated entities

On June 12, 2025, the ANP Board approved the launch of a public consultation and a public hearing aimed at updating the minimum paid-in capital requirement for various regulated entities.

The consultation will address amendments to ANP Resolutions 937, 938, 941, 942, 943, 950 and 957, all published on October 5, 2023. These resolutions under analysis provide for transporter-reseller-retailer (TRR) activities, liquid fuel distribution, LPG (cooking gas) distribution, solvent distribution, finished lubricating oil production, and the collection and re-refining of used or contaminated lubricating oil (OLUC).

Under current regulations, authorization to carry out these activities requires a Registry of Commerce certificate that proves the minimum paid-in capital and demonstrates the company’s financial health and its capacity to bear the inherent risks of the sector. These activities involve products that are flammable and potentially polluting, but essential to the Brazilian economy.

Find out more: ANP to hold public consultation and hearing on updating minimum capital requirement for regulated entities

ANP launches 2nd Cycle of the Production Sharing Open Acreage

On June 17, 2025, the ANP published in the Federal Official Gazette of Brazil the schedule for the 3rd Cycle Production Sharing Open Acreage (“OPP”). The public bidding session is scheduled for October 22, 2025.

This new cycle was initiated after the OPP’s Special Bidding Commission (“CEL”) approved a declaration of interest together with a bid guarantee during a meeting held on June 16, 2025. According to the current version of the OPP tender protocol, up to 13 exploratory blocks located in the Santos and Campos basins can be offered during the public session.

Registered companies interested in specific blocks must submit a declaration of interest and a bid guarantee by August 6, 2025. The final list of blocks to be offered in the public session will be published on August 20, 2025.

Find out more: Production Sharing Open Acreage (“OPP”): ANP initiates 3rd Cycle

5th Cycle of Open Acreage of Concession breaks subscription bonus record

On June 17, 2025, the ANP held the public session for the 5th Cycle of Open Acreage of Concession (“OPC”).

As informed by ANP, a record-breaking BRL 989,261,000.96 was collected in subscription bonuses, with a premium exceeding 500% over the minimum amount set in the tender notice.

In total, 34 blocks were awarded to 9 companies, located in the onshore Parecis Basin and the offshore Foz do Amazonas, Santos, and Pelotas basins. The ANP estimates investments of BRL 1,456,963,000.00 in the initial exploration phase of the contracts.

According to the ANP’s interim Director-General at the time, Patricia Baran, blocks in the equatorial margin recorded premiums of nearly 3000% and attracted significant competition in 7 of the 19 blocks offered. This was the first time the region was included in the open acreage modality.

The winning bidders must now comply with the next steps of the schedule, such as submitting required documents and paying the subscription bonus. Contracts are expected to be signed on November 28, 2025.

Find out more: Open Acreage of Concession (“OPC”):5th cycle breaks subscription bonus record

NOTÍCIAS

ANP approves revision of natural gas quality control specifications

On May 15, 2025, the ANP’s Board of Directors approved the revision of ANP Resolution No. 16/2008, which defines the requirements for authorizing the production of biofuels.

Some of the key points revised by ANP Resolution 982/2025 were:

- Natural gas will now be analyzed by online sampling, allowing for further daily analyses.

- The oxygen content in the Northern region will be reduced, adopting the same standards as other areas across Brazil.

- Analyzing the mercury content in natural gas produced domestically will be mandatory, not just for imports.

- Natural gas with different specifications, transported compulsorily by a suitable vehicle or dedicated pipeline, will only be allowed to be marketed to industrial consumers and electricity generators.

- The deadlines for meeting and adapting to the new specifications have been extended.

Navy and ANP enter into partnership to expand continental shelf in the Eastern/Meridional Margin

On May 26, 2025, the ANP announced a partnership with the Brazilian Navy in its project to request the expansion of the Brazilian continental shelf.

Such a survey would refer to the Eastern/Meridional Margin, which is located on the coast of the South, Southeast, and Northeast regions.

The project depends on the approval of the United Nations (“UN”). In March 2025, the ANP approved a similar project to expand this shelf in the North and Northeast regions. The technical data that the ANP will provide will be essential for such approval since the research could, in theory, prove that the rocks in the submerged portion correspond to a natural extension of the Brazilian continental shelf.

ANP approves new disclosure method for incident-related data

On May 29, 2025, the ANP’s Board of Directors approved a new method for disclosing data relating to incidents in oil and natural gas (E&P) exploration and production activities on its website.

The change will be published in a new technical note, which will replace the one in force until then, Technical Note No. 202/SSM/2017.

The main change is that the ANP will now announce the operator and the facility where the incident occurred immediately after receiving notification of such. Previously, publication took place after the incident had been investigated, in the investigation reports.

Resumption of the 2024 Capacity Offering and Contracting Process (POCC) for Gasbol approved

On May 29, 2025, the ANP’s Board of Directors approved the resumption of the 2024 Natural Gas Transportation Capacity Offering and Contracting Process for Transportadora Brasileira Gasoduto Bolívia-Brasil (“POCC 2024 TBG”), covering the period from 2025 to 2029.

The ANP had temporarily suspended POCC 2024 TBG in December 2024. At the time, the ANP identified a risk of a significant increase in tariffs in relation to the transportation contract values in force until then.

After analysis by the ANP’s Technical Area of the methodology for calculating the tariff to be adopted by the carrier, the process was resumed. The alternative approved by the ANP’s Board of Directors to mitigate the potential increase in tariffs was to use 60% of the balance of the so-called “regulatory account”, which records the difference between a carrier’s Maximum Permitted Revenue (“RMP”), which the ANP established, and the revenue it actually received in a given period. The balance of the regulatory account implies an adjustment in the RMP for the following periods or can be used to fund investments in the transportation system, at the discretion of the ANP.

ANP’s Regulatory Agenda for 2025-2026 approved

On May 30, 2025, the ANP’s Board of Directors approved its regulatory agenda for the 2025-2026 period.

This is an instrument that aims to:

- Plan regulatory actions to meet the market’s needs;

- Increase transparency throughout the regulatory process; and

- Encourage social participation in the drafting of regulations and the resolution of regulatory problems.

The regulatory agenda distributes the regulatory actions that the ANP intends to carry out to solve problems or market failures into thematic axes. These actions may result in the drafting or revision of regulations.

The thematic axes outlined in the agenda are listed as follows:

- Exploration and production (18 stocks, 9 of which are new);

- Oil, Derivatives, Natural Gas, and Biofuels (10 shares, 1 of which is new);

- Production of Oil, Natural Gas, and Biofuels Derivatives (3 actions transferred);

- Supply, Supply Supervision, and Product Quality (23 actions, 16 of which are new); and

- Cross-sector (2 new actions).

According to the ANP, 28 (representing 50%) of the actions were transferred from the previous agenda to the current one because they were not completed.

Oil and natural gas production in the pre-salt reaches record in April 2025

On June 03, 2025, the ANP published the Monthly Newsletter of Oil and Natural Gas Production for April 2025, which indicated positive results in this area.

PRE-SALT

A record 3.734 million barrels of equivalent oil per day (boe/d) were produced, representing an increase of 0.5% compared to March 2025 and 18.3% compared to April 2024.

NATIONAL TOTAL PRODUCTION

The sum of oil and natural gas produced in pre-salt and post-salt was 4.689 million boe/d.

OIL

Individually, 3.632 million bbl/d of oil were produced, representing an increase of 0.3% compared to March 2025 and 13.7% compared to April 2024.

NATURAL GAS

Production of 168.01 million m³/d, representing an increase of 22.9% compared to the same period in 2024. Its use rate was 97.1%, with a 13.6% increase in burning compared to March 2025.

Check out the consolidated data below:

| Type of production | April 2025 | Variation (%) |

| Pre-salt (boe/d) | 3,734,000 | ↑0.5 vs Mar/25 ↑18.3 vs Apr/24 |

| Total National Production (boe/d) | 4,689,000 | — |

| Oil (bbl/d) | 3,632,000 | ↑0.3 vs Mar/25 ↑13.7 vs Apr/24 |

| Natural Gas (Million m³/d) | 168.01 | ↑22.9 vs Apr/24 |

| Gas Use (%) | 97.1% | ↑13.6% vs Mar/25 |

Production: Oil and natural gas hit record highs in April

On June 03, 2025, the ANP published the Monthly Newsletter of Oil and Natural Gas Production, which presents consolidated Brazilian production data.

During the period, a new record was set for pre-salt production, reaching 3.734 million barrels of oil equivalent per day (boe/d) — a 0.5% increase compared to March and an 18.3% rise over April 2024.

Pre-salt production, sourced from 164 wells, accounted for 79.7% of the total national output. Specifically, 2.896 million barrels of oil and 133.33 million cubic meters of natural gas were produced daily.

In total — including pre-salt, post-salt, and onshore fields — national production reached 4.689 million boe/d. Oil production stood at 3.632 million barrels per day, up 0.3% from the previous month and 13.7% year-over-year. Natural gas production, in turn, reached 168.01 million cubic meters per day, growing 1.5% from March and 22.9% year-over-year.

The use of natural gas amounted to a 97.1% rate in April. A total of 55.36 million cubic meters per day were made available to the market, while 4.98 million cubic meters were flared daily. This represents a 13.6% reduction in flaring compared to the previous month, mainly due to the commissioning of part of the compressors on the Almirante Tamandaré FPSO, which began injecting natural gas and thus reduced flaring volumes. On a year-over-year basis, however, flaring increased by 25.5%.

Offshore fields accounted for 97.6% of oil and 87.1% of natural gas production. Fields operated by Petrobras, either individually or in consortium, represented 89.76% of the total national output. Production was carried out in 6,505 wells, including 538 offshore and 5,967 onshore wells.

Find out more: Pre-salt oil and natural gas production hits record highs in April

ANP launches dashboard for production phase activities and investments

On June 9, 2025, the ANP released the Dynamic Dashboard of Activities and Investments in the Production Phase — a new interactive tool designed to improve transparency regarding the second phase of exploration and production contracts in Brazil.

The dashboard compiles information declared by contractors in the Annual Work and Budget Programs (“PATs”) of active contracts. The platform can filter data by basin, year, environment, activity type, and currency. Among the highlights are investments made between 2022 and 2024 amounting to nearly BRL 190 billion. Of this amount, 61.6% were allocated to the Santos Basin and 33.1% to the Campos Basin.

The dashboard also features charts showing the annual evolution of activities and investments. In 2024, the construction of stationary production units (UEPs), such as platforms, accounted for 27% of total investments during the period.

Find out more:ANP launches dynamic panel for activities and investments in the production phase

ANP approves consultation on transport system development plan

On June 26, 2025, the ANP approved the launch of a 45-day public consultation regarding the Coordinated Plan for the Development of the Natural Gas Transportation System.

The plan was developed by the Association of Natural Gas Pipeline Transport Companies (ATGás) in collaboration with transporters Nova Transportadora do Sudeste (NTS), Transportadora Brasileira Gasoduto Bolívia-Brasil S.A. (TBG), and Transportadora Associada de Gás S.A. (TAG).

This plan was proposed by transporters and outlines measures for optimizing, reinforcing, expanding, and constructing new infrastructure for the natural gas transportation system under ANP regulations.

In line with the New Gas Law (Law No. 14,134/2021), the plan aims to meet demand for gas transportation, diversify gas sources, and promote supply security for ten years, as regulated by the ANP.

The New Gas Law assigns the ANP the role of evaluating coordinated plans and, after a public consultation, approving them (Article 15, paragraph 4).

Find out more:Natural Gas: ANP will hold public consultation on Coordinated Transport System Development Plan

ANP releases consolidated industry data for 2024

On June 30, 2025, the ANP published consolidated data on the development of the oil, natural gas, and biofuels sector in Brazil in 2024.

The data is available on the “Oil, Natural Gas and Biofuels Statistical Yearbook 2025” page and includes charts, tables, graphs, cartograms, and texts organized into five thematic sections.

According to the yearbook, total oil reserves grew by 6% compared to 2023, reaching 29.2 billion barrels, while proven reserves totaled 16.8 billion barrels, also up 6%. National oil production, however, declined by 1%, reaching 3.4 million barrels per day. In the pre-salt, average production was 2.6 million barrels per day, accounting for 78.8% of Brazil’s total output. Oil exports reached 1.7 million barrels per day, while imports stood at 282,000 barrels per day.

As for natural gas, total reserves increased by 5.1%, totaling 740.5 billion cubic meters, and proven reserves reached 546 billion cubic meters, up 5.6%. Daily national production rose by 2.5%, marking the 15th consecutive year of growth, and reached 153.2 million cubic meters. The pre-salt accounted for 76.7% of this production.

National production of oil derivatives grew by 1.2%, totaling 2.2 million barrels per day, equivalent to 86.4% of installed refining capacity. Sales of derivatives by distributors increased by 0.6% — aviation kerosene standing out with a 6.8% increase in sales.

Contractual obligations for investments in Research, Development, and Innovation (“R&D&I”) totaled BRL 4.2 billion in 2024, an 8.5% increase over the previous year. Government take reached BRL 98.9 billion, up 2%.

The published data covers five sections:

- The Brazilian Oil and Natural Gas Industry

- Trade

- Biofuels

- Bidding blocks

- ANP resolutions

The international data, which will comprise Chapter 1 of the Yearbook, is scheduled for release on July 31.

Find out more: ANP releases 2024 consolidated data of the regulated sector

Power

HIGHLIGHTS

Provisional measure on Power Sector published

On May 21, 2025, Provisional Measure (“MP”) No. 1,300 was published, establishing the reform of the Electric Sector in Brazil.

Overall, MP No. 1,300 underwent 600 amendments. Currently, it is awaiting a decision by the joint committee (to be established).

In order to contribute to the technical and legal understanding of MP No. 1,300, Demarest an in-depth analysis of the main regulatory and contractual effects arising from MP No. 1,300.

MME publishes schedule of transmission auctions

On June 03, 2025, MME Normative Ordinance No. 110/2025 was published, through which the Ministry of Mines and Energy (“MME”) establishes the schedule for transmission concession bids.

In order to hold bids for transmission facilities integrating the Basic Grid that involve power transformers with a primary voltage equal to or greater than 230 kV as well as secondary and tertiary voltages below this level, it will be necessary to enter into a primary Transmission System Use Contract (“CUST”) with the energy distributors and the National Electricity System Operator (“ONS”).

Check out the schedule:

| Auction | Public Session | Deadline for CUST execution |

| 1st/2025 | October 2025 | April 05, 2025

|

| 1st/2026 | April 2026 | October 15, 2025

|

| 2nd/2026 | October 2026 | April 15, 2026

|

| 1st/2027 | April 2027 | October 15, 2026

|

| 2nd/2027 | October 2027 | April 15, 2027

|

Access Normative Ordinance No. 110/2025 in full.

ONS publishes report on curtailment

On June 17, 2025, the ONS published Technical Report No. 0189/2025, which analyzed the evolution of forced generation cuts in the National Interconnected System (“SIN”), the so-called “curtailment ”.

The projections indicate that energy curtailment tends to intensify, especially during the day, when solar generation is high and net load is reduced. Conversely, reliability cuts are expected to decrease with the expansion of the transmission grid, although local restrictions may still limit this advance. The entry of new plants with guaranteed access to the grid can raise the average curtailment to 10% in wind and to more than 20% in photovoltaic plants.

The study also indicates that the lack of integration of Micro and Mini Distributed Generation (“MMGD”) into the ONS’ control mechanisms generates distortions and overloads centralized plants, hindering system management.

Given this scenario, the study recommends coordinated actions in the regulatory, operational, and planning fields. The goal is to ensure SIN’s safe, efficient, and fair operations, thus promoting a sustainable model for the Brazilian electricity sector.

Budget cut compromises ANEEL’s operations as of July 2025

On June 18, 2025, the Brazilian National Electric Energy Agency (“ANEEL”) reported to the Ministry of Planning and Budget (“MPO”) that, due to a cut of BRL 38.62 million provided for in Decree No. 12,477/2025, the agency will be forced to significantly reduce its operations as of July 01, 2025. As a result, the agency’s budget was reduced to BRL 117.01 2025 — less than that approved in the 2025 Annual Budget Law (BRL 155,64 million), and far below the amount initially requested of BRL 239,76 million.

Some of the measures announced include:

- Suspension of the Ombudsman telephone service;

- Limitation of opening hours from 8 a.m. to 2 p.m.;

- Interruption of decentralized inspections in collaboration with state agencies;

- Restriction of public hearings, consumer satisfaction surveys, training of new employees, and information technology services.

ANEEL warns that such budget reductions compromise consumer protection and compliance with its legal duties. Correcting such a deficiency is paramount to ensuring the continuity of ANEEL’s regulatory operations and further attracting private investments needed to develop the power sector for the benefit of society in general.

Access Decree No. 12,477/2025.

Public consultation launched on guidelines for applying TUST/TUSD discounts under Provisional Measure No. 1,300

On June 24, 2025, the MME launched Public Consultation (“CP”) No. 187/2025, aimed at gathering contributions on the draft ordinance and related technical documents concerning the guidelines for applying discounts on Transmission and Distribution System Usage Tariffs (“TUST/TUSD”) at the consumption end.

CP No. 187/2025 seeks to address the integration of provisions introduced by Provisional Measure (“MP”) No. 1,300/2025, which establishes the termination of TUST/TUSD discounts at the consumption end, while providing a transitional regime for agreements registered with the Electric Energy Trading Chamber (“CCEE”) by December 31, 2025.

Access the e-book prepared by our Energy and Natural Resources team on the topic.

The key topics addressed in CP No. 187/2025 include:

Parameters for Maintaining Discounts

The proposal outlines the mandatory data to be submitted and validated with the CCEE to maintain discounts under power purchase agreements (“PPAs”), as follows:

- Annual contracted energy volume (in average MW) per calendar year, while the agreement remains in effect;

- Agreed lower and upper flexibility percentages, linked to consumption or generation metering, if applicable;

- Identification of consumer units (“UCs”) and associated power plants, if applicable; and

- Portion of consumption and generation metering linked to the agreement, if applicable.

These parameters cannot be modified after December 31, 2025. However, for accounting and settlement purposes in the Short-Term Market (“MCP”), the monthly PPA volume can be adjusted by mutual agreement without affecting discount eligibility, and the parties remain subject to the special charge.

Flexibility

PPA flexibility is capped at approximately 20%. If not validated by both parties, the flexibility percentages will be deemed null.

Deviation Assessment

The MP assigns responsibility to the CCEE for annually assessing positive or negative deviations between the registered and validated energy volume (as of December 31, 2025) and the actual volume delivered. Deviations will be subject to a special charge, allocated to the Energy Development Account (“CDE”).

The amounts actually incurred will be verified based on consumption or generation metering, as applicable, as well as on the monthly amounts effectively recorded and validated in the CCEE for the purposes of accounting and settlement in the MCP.

The deviation will correspond to the greater amount between:

- The absolute difference between the annual contracted volume and the sum of the monthly volume registered and validated with the CCEE; and

- The absolute difference between the annual contracted volume and the actual consumption or generation metering.

Deviations below 5% are exempt from this charge.

Additionally, the calculation of deviations must consider the interval defined by the application of the lower and upper flexibility percentages. If the deviation falls within this interval and corresponds to the sum of the monthly amounts actually registered and validated with the CCEE, the charge will not be due.

Special Charges

The amount of the charge to be paid will correspond to the result of the multiplication of:

- The unit cost of the charge (BRL/MWh), to be defined by ANEEL; and

- the deviation.

The charge will be equally split between the contracting parties, and non-payment will result in penalties.

The draft ordinance provides distinct calculation criteria based on the nature of the buyer. In addition, an attachment to the CP was provided, including tables of the unit costs resulting from the apportionment of the annual CDE quotas for 2025, and an indication of the corresponding unit costs for the special charge and charge calculation simulations.

- If the buyer is a consumer:Charge equals three times the unit cost of the CDE quota, included in the corresponding UC’s TUST/TUSD via tariff surcharge:

| Region | Voltage level of the contracting consumer unit | Unit cost of the CDE apportionment (BRL/MWh) | Unit cost of the special charge (BRL/MWh) |

|---|---|---|---|

North |

High | R$ 33.11 | R$ 99.33 |

| Northeast | Medium | R$ 52.03 | R$ 156.09 |

| Southeast/South | High | R$ 56.95 | R$ 170.85 |

| Midwest | Medium | R$ 89.49 | R$ 268.47

|

- If the buyer is not a consumer:Charge equals three times the national average unit cost of the CDE quota:

Region Voltage level of the contracting consumer unit Unit cost of the CDE apportionment (BRL/MWh) Unit cost of the special charge (BRL/MWh) does not apply) (does not apply) R$ 85.31 R$ 255.93

Power Plants Unable to Be Modeled by December

For plants unable to complete asset registration by December 31, 2025, PPAs can be registered and validated through a commitment term, which must include:

- The plant’s authorization and the Generation Plant Identification Code (“CEG”) data;

- PPA parameters for discount eligibility; and

- Signatures of the contracting party representatives and two witnesses. The commitment term and a PPA copy must be submitted to the CCEE by December 31, 2025.

These plants will be subject to the special charge even in the event of a commercial operation delay or authorization revocation, until the registration is canceled.

Fraud Indicators and Notification to ANEEL

If fraud or simulation is suspected in obtaining discounts, the CCEE will notify ANEEL through a detailed report for investigation and potential sanctions.

Consumers Represented by Retail Agents

Discount eligibility depends on completing the UC identification and qualification process by December 31, 2025, and is limited to the duration of the retail marketing contract signed for the purposes of qualification. The special charge also applies to contracts entered into, registered, and validated by retail agents.

Technical Note No. 8/2025, attached to the CP, states that “the amendment is accompanied by a transitional period, ensuring that rights involving existing agreements are maintained, subject to the conditions established, aiming to ensure proper application.”

Interested parties must submit their contributions by July 24, 2025, through the MME Portal.

Access the draft ordinance in full.

Access the technical note in full.

Access the CP article in full.

NEWS

ANEEL approves new methodology for operational costs

On May 23, 2025, REN No. 1,121/2025 was published, which approved version 5.0 of Submodule 2.2 of Tariff Regulation Procedures (“PRORET”) and the subsequent improvement of the methodology for calculating regulatory operational costs to be considered in the periodic tariff reviews of distributors. The new methodology will not be applied to tariff reviews whose public consultations have been initiated in 2025.

Read Normative Resolution No. 1,121/2025 in full.

MME initiates public consultation on first issuance of 2025 POTEE

On May 23, 2025, the MME established Public Consultation (“CP”) No. 185/2025, on the proposal of the 1st Issuance of the Electricity Transmission Concession Plan (“POTEE”) for 2025 – Expansions and Reinforcements – Basic Grid and Other Transmission Facilities, which was open for contributions until June 23, 2025.

The concessionaires listed in the 2025 POTEE must verify that the description of each extension or reinforcement indicated is compatible with the facilities under their responsibility and adequate for the purposes of understanding, detailing the projects and budgeting.

Access the ordinance that established CP No. 185/2025.

Access CP No. 185/2025.

Amendment to REN No. 1,009/2022 and 700 GWh/year distributors’ bids

On May 26, 2025, REN No. 1,120/2025 was published, amending REN No. 1,009/2022 and PRORET’s Submodule 11.1 “Distributor with Market under 700 GWh/year”.

The amendment prohibits the participation of related parties in bidding processes held by distributors with a market under 700 GWh/year. As published by the Brazilian Electricity Regulatory Agency (“ANEEL”), the proposal aligns the regulations with the legal provisions established by Laws No. 14,133/2021 (the Bidding and Administrative Contracts Law), No. 12,813 of 2013 (on conflicts of interest), and No. 14,596/2023 (on transfer pricing rules), ensuring greater transparency and legal certainty.

The regulation also reclassifies Energy Trading Contracts with a Supplying Agent (“CCESUP”) from the approval procedure to the registration procedure, with a view to streamlining the procedure due to the specificities of this type of contract, such as the pricing established by ANEEL and strict inspections of the amounts of energy contracted.

Access REN No. 1,120/2025 in full.

Daniel Cardoso Danna joins ANEEL’s Board of Directors

On May 26, 2025, ANEEL Ordinance No. 159/2025 was published, which called Daniel Cardoso Danna to integrate the ANEELs’ Board of Directors as deputy director. The appointment begins on May 26, 2025, and will be in force for 180 days or until the new member of ANEEL’s board of directors is appointed and takes office, whichever occurs first. The measure comes as the mandate of the former director, Ricardo Lavorato Tili, comes to an end. With the appointment of the substitute director, numerous cases under Ricardo Tili’s supervision were redistributed to other ANEEL directors.

Access CGIEE Resolution No. 159/2025 in full

Regulations published on access to the Basic Grid

On May 26, 2025, Normative Resolution (“REN”) No. 1,122/2025 was published, approving Revision 4 of Module 5 of the Transmission Rules and establishing access regulations to the Basic Grid for consumers.

Following the publication of the regulation, consumers will be required to provide financial guarantees as a condition for requesting access and entering into CUST agreements. This measure enhances grid security and supports its expansion, while ensuring that electro-intensive consumers are effectively connected, preventing grid capacity from being allocated without actual development These measures take effect upon the publication of the resolution.

The management of the financial guarantees relating to users’ access to the transmission system will also be incorporated into the resources required for the ONS budget, in line with the amendment to REN No. 1,017/2025 (which regulates the ONS’s operations).

Access REN No. 1,122/2025 in full.

Methodology published for collecting CUST termination charges

On June 05, 2025, REN No. 1,125/2025 was published, establishing the methodology for assessing the maximum diligence of transmission companies in collecting CUST termination charges. This methodology applies to CUST agreements entered into without the financial guarantees required by Order No. 3,245/2023 and that were terminated by the publication date of Order No. 1,687/2024. CUST agreements that could not be formally terminated due to a court decision are also included, provided that the decision did not rule out the enforceability of termination charges.

“Maximum diligence” is defined in the regulation as:

- Registration of the debtor in ANEEL’s Default Register;

- Extrajudicial debt collection efforts;

- Filing a lawsuit to recover the credit; and Legal action initiated by the ONS.

Items “i” and “ii” must be implemented by creditors (transmission companies) within 180 days from the publication of the regulation (that is, by December 02, 2025), or from the termination date of contracts that could not be terminated due to a court decision.

Item “iii” must be implemented by the ONS. The agency is responsible for implementing the appropriate measures to reclaim credits before the Judiciary Branch. After implementing these measures, the ONS must also submit annual information (every March 31) to ANEEL, such as:

- the list of open debits and corresponding amounts;

- the collection measures taken;

- the results obtained as well as the rationale for any failures in reclaiming credits;

- the diligence report of transmission companies throughout the legal proceeding; among others.

Access REN No. 1,125/2025 in full.

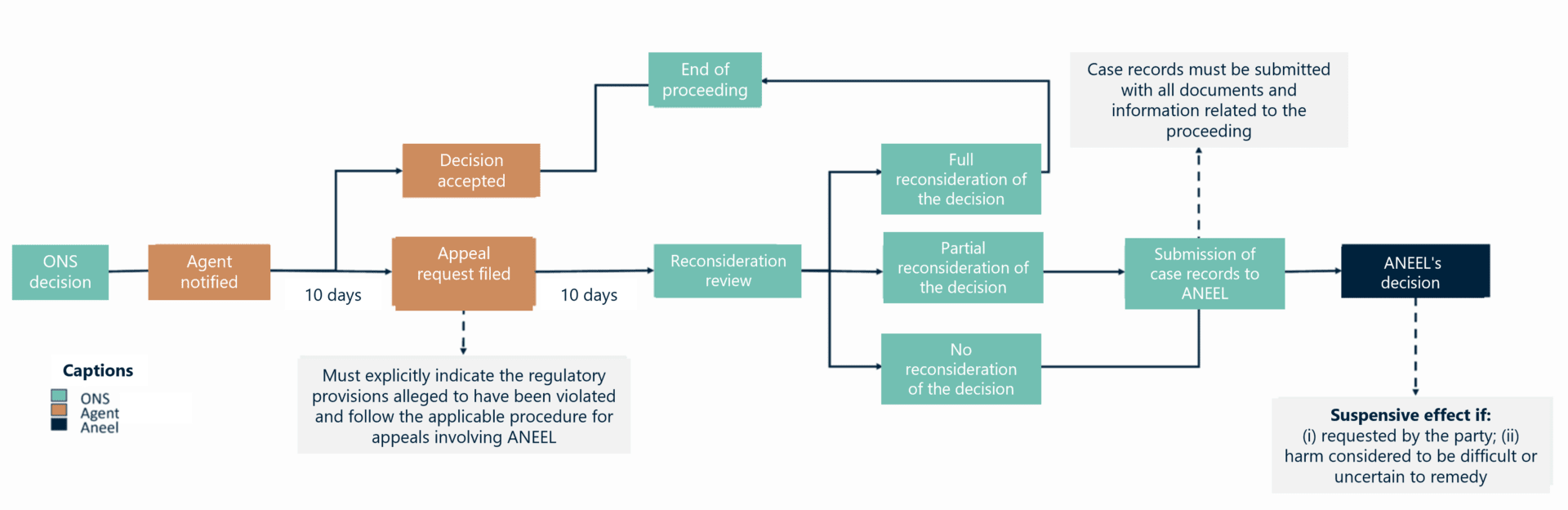

Regulation published on appeals against ONS decisions

On June 09, 2025, ANEEL’s REN No. 1107/2024, which was published in December 2024, came into force to regulate the filing of appeals against ONS decisions. On the same date, ANEEL’s Order No. 1,700/2025 was published, amending the ONS Network Procedures.

The challenge procedure will observe the flowchart below:

Access theclient alert prepared by Demarest’s Energy and Natural Resources team on this topic.

Access REN No. 1,107/2024 in full.

Access ANEEL No. 1,700/2025 in full.

ONS opens registrations for participation in competitive Demand Response mechanism – 2025 Product Availability

On June 02, the ONS opened applications for participation in the competitive mechanism aimed at acquiring the Demand Response availability product under the Regulatory Sandbox provided for by ANEEL Authorizing Resolution No. 12,600/2022. The registration deadline is July 14, 2025.

Eligible consumers and aggregating agents, duly qualified in compliance with the applicable regulations, may participate in the bidding process.

The ONS will contract up to two products, with six and four monthly activations, each for a four-hour period (from 6 p.m. to 10 p.m.) on business days, from September 01, 2025, to January 31, 2026.

Access the list of files and other relevant information.

ANEEL establishes implementation of the new Social Tariff under Provisional Measure No. 1,300/2025

On June 18, 2025, ANEEL published Order No. 1,731/2025, establishing the guidelines for implementing the Social Tariff of Electric Energy (“TSEE”), in compliance with the provisions of MP No. 1,300/2025.

The order establishes that, as of July 05, 2025, and while such MP remains in effect —or, if converted into law with the same provisions, until ANEEL’s regulations are amended — the following rules shall apply:

- Considering the discount established by MP No. 1,300/2025 for bills issued as of July 05, 2025, the following provisions will no longer apply: (a) the progressive discounts established in paragraphs 1st and 2nd of Art. 179 of REN No. 1,000/2021; (b) the procedure for calculating the progressive discount, in force prior to the MP, established in Art. 2 of REN No. 472/2012; and (c) the ‘low-income residential’ discounts in Table 3 of the approval resolutions of tariffs in effect;

- The availability cost of 80 kWh used for three-phase systems and measured consumption inferior to or equal to 80 kWh for ‘low-income residential’ subclasses; and

- The monthly revenue difference approved, based on data from the billing system for the previous year’s December billing cycle regarding consumer units classified under the ‘low-income residential’ subclasses, thus waiving the submission in the format established in Annex I of REN No. 472/2012.

Access ANEEL No. 1,731/2025 in full.

Renewables and other Energy Sources

HIGHLIGHTS

Brazil’s Finance Minister attends 38th Global Conference of Milken Institute

On May 05, 2025, during the 38th Global Conference of the Milken Institute, Finance Minister Fernando Haddad presented the Federal Government’s perspective on strategic issues such as sustainable growth, ecological transformation, industrial policy, and the digital economy Among the topics addressed was the National Data Center Policy, which is expected to be published soon.

According to Minister Haddad, this policy anticipates the effects of the Tax Reform on the digital sector and reduces taxes on investments made in Brazil in this area, as well as on the export of services provided by data centers. The minister also emphasized that the policy seeks to integrate technology and sustainability. The goal is to ensure that data centers operate using clean energy and that data processing is carried out with cybersecurity and legal safeguards, offering, in the minister’s words, “the best possible service” to the world.

Brazil and China announce partnership on renewable energy initiatives

On May 12, 2025, Brazilian President Luiz Inácio Lula da Silva visited China to hold four meetings with executives from Chinese companies operating in the sustainable energy sector. The meetings led to the announcement of approximately USD 1 billion in investments in the production of Sustainable Aviation Fuel (SAF) by the Envision Group. Additionally, a Research and Development (R&D) Center focused on renewable energy will be established through a partnership between Windey Technology and Senai-Cimatec.

Brazil advances in industrial decarbonization with international support

On June 11, 2025, the Trust Fund Committee of the Climate Investment Funds (“CIF”) approved an investment plan of USD 250 million (approximately BRL 1.3 billion) for Brazil. The aim is to foster industrial decarbonization, especially in emission-intensive sectors such as cement, steel, aluminum, chemicals and fertilizers.

The initiative seeks to accelerate the development and implementation of low-carbon technologies, promoting innovation and development of the circular economy. The plan will be detailed in the coming months and subsequently submitted for CIF’s final approval.

MME highlights role of offshore wind plants in decarbonizing Brazilian industry

On May 26, 2025, the Ministry of Mines and Energy (“MME”) participated in “Brazil Offshore Wind & Power-to-X 2025” and highlighted offshore wind energy as a key player in the decarbonization of Brazilian industry and in the transition to a cleaner and more sustainable energy matrix.

During the 2nd edition of the “Brazil Offshore Wind Summit”, held in Rio de Janeiro, the MME’s national secretary for energy transition and planning, Thiago Barral, emphasized that offshore wind energy is part of the portfolio of solutions for Brazil’s energy transition.

Brazil has significant technical potential for offshore wind power generation, estimated at more than 1,200 gigawatts (GW), representing four times the country’s current installed capacity. This potential is especially relevant in the Northeast, Southeast, and South regions, where conditions are favorable for installing offshore wind farms.

To enable the development of this sector, the Brazilian Government has sought to establish an appropriate legal and regulatory framework to attract investment and ensure legal certainty for projects. Brazil’s membership in the Global Offshore Wind Alliance (GOWA), formalized during COP 28 in Dubai, reflects the country’s commitment to promoting renewable energies and international collaboration to advance the sector.

Studies carried out by the World Bank, in partnership with the Energy Research Company (“EPE”), indicate that offshore wind energy development in Brazil could generate more than 516,000 jobs by 2050 and at least BRL 900 billion for the national economy. In addition, the energy generated by these sources can produce green hydrogen, expanding the opportunities for exporting clean energy and contributing to the decarbonization of emission-intensive industrial sectors.

With the approval of the regulatory framework for offshore wind, Brazil is progressing toward consolidating a diversified and sustainable energy matrix, aligning itself with international climate targets, and strengthening its position as a leader in generating renewable energy.

Number of industries investing in renewable sources grows

On June 05, 2025, the Brazilian National Confederation of Industry (“CNI”) published a new survey indicating that 48% of companies are investing in actions or projects involving the use of renewable energy.

While this figure is significant on its own, it also represents a notable 14% increase in just one year compared to 2023 (34%).

According to Roberto Muniz, CNI’s Director of Institutional Relations, this growth reflects Brazilian industry’s clear and growing commitment sustainability, reinforcing Brazil’s position as a global hub for clean energy. This shift also offers a cost-reduction and control strategy, given that becoming a self-producer exempts the consumer from certain charges enforced on the sector.

In regard to company size, 44% of small businesses already invest in self-generation. Among medium and large companies, 36% are self-generators, 51% purchase incentivized energy, and 9% have distributed generation systems. Regionally, the Northeast leads in renewable energy adoption, with an impressive 60% of companies in the region engaged in clean energy projects, while the Southeast recorded 39%.

Find out more: More industries are investing in renewable energy sources, claims CNI – Novacana.com

New biofuel certification standard approved

On June 12, 2025, the ANP approved a review of ANP Resolution No. 758 of 2018, which establishes procedures for the certification of efficient production and import of biofuels, and the accreditation of inspectors within the scope of the National Biofuels Policy (“RenovaBio”).

Among its key improvements, ANP Resolution No. 984/2025:

- Expedites updates to fields and data in RenovaCalc (calculator that quantifies biofuel-related greenhouse gas emissions from the agricultural phase to its use in transportation).

- Details guidelines for assembling the inspectors’ audit teams.

- Provides for penalties against biofuel companies and producers.

- Amends certification rules for new biofuel producers initiating operations;

- Updates document submission deadline.

- Provides for the qualification of foreign biofuels producers and clarifies eligibility criteria for such producers.

- Addresses certificate ownership transfer.

- Establishes a procedure for cases involving a change of course.

- Includes procedures related to the chain of custody (process through which information on raw materials, intermediate products and end products is transferred, monitored, and controlled as they progress through each stage of the supply chain).

Find out more: RenovaBio:New biofuel certification standard approved

Brazil celebrates recognition of corn-based ethanol for sustainable aviation fuel production

On June 30, 2025, the Ministry of Mines and Energy (“MME”) celebrated the International Civil Aviation Organization’s (“ICAO”) decision to recognize the environmental and productive benefits of multicropping — particularly second-crop corn, known as safrinha — for the production of Sustainable Aviation Fuel (“SAF”).

The decision was made possible through joint efforts by the MME, the Ministry of Foreign Affairs (MRE), and Brazil’s National Civil Aviation Agency (ANAC).

Approved on June 27, 2025, the measure introduces an alternative methodology for calculating Indirect Land Use Change (ILUC), recognizing second-crop corn as a more sustainable feedstock for SAF production. The MME expects this will attract further investment and boost Brazil’s potential for SAF production.

The ICAO decision also approved carbon intensity values for SAF produced from second-crop corn-based ethanol using the Ethanol-to-Jet technology. This approval is expected to expand national production and strengthen Brazil’s participation in low-carbon aviation.

Find out more: Silveira celebrates international recognition of corn-based ethanol for sustainable aviation fuel production

NEWS

Brazil, India, and Egypt emerge as key players in new solar industrial belt

On June 20, 2025, a report published by the Mission Possible Partnership (“MPP”), which is an organization dedicated to industrial decarbonization, highlighted the emergence of a “solar industrial belt”, – formed mainly by Brazil, India, and Australia – challenging the dominance of China, the United States, and the European Union in the renewable energy sector.

The report indicates an investment potential of USD 775 billion across these countries, representing approximately half of the current global investment potential. Brazil’s rise in this landscape should therefore be seen not only as an economic advantage, but also as a strategic commitment to a more sustainable future. Such leadership, however, will require sustained public policies, robust infrastructure investment, and a stable legal environment to attract investors. This is a promising moment, and Brazil has all the conditions to become a global leader in clean energy.

Access the report of the Mission Possible Partnership

Rio de Janeiro City Council transitions to 100% sustainable energy

On June 5, 2025, the City Council of Rio de Janeiro entered into an agreement formalizing the use of 100% sustainable energy at the Legislative Branch’s headquarters.

In addition to generating estimated savings of around BRL 1 million per month, the initiative marks a new milestone: The new headquarters (Edifício Serrador) is now the first legislative house in Latin America to transition entirely to renewable energy sources.

The initiative is part of the Rio Green Energy Efficiency Program (Programa de Eficiência Energética Rio Energia Verde), launched in 2021 by the municipal government. The program aims to position Rio de Janeiro at the forefront of global innovation and integration with sustainable energy solutions.

Find out more: Rio City Council transitions to 100% renewable energy

Brazil ranks 1st in global industry decarbonization program

On June 13, 2025, the Climate Investment Funds (“CIF”) announced that Brazil ranked 1st in the Industry Decarbonization Program (PID).

As a result, Brazil will receive BRL 1.3 billion in funding to expand clean and circular technologies. Subsequently, an investment plan will be developed to attract private investments toward global energy transition.

According to the Ministry of Mines and Energy (MME), part of these investments will be allocated to low-carbon hydrogen hub projects. This marks the first phase of a global financing initiative aimed at mitigating industrial greenhouse gas (GHG) emissions in developing countries. In total, approximately BRL 5.5 billion will be available for this project.

Find out more: Industry decarbonization: Brazil ranks 1st in global program and will receive more than BRL 1 billion

State of Rio de Janeiro publishes biomethane regulation

On June 26, 2025, the Governor of Rio de Janeiro signed a new decree to regulate Law No. 6,361/2012, which established the State Policy on Renewable Natural Gas.

The final and approved wording of the decree removed the existing price cap for biomethane acquisition (previously set at BRL 1.20 per cubic meter), which was seen as a barrier to implementing the state policy.

The new decree sets out general rules for complying with the state policy’s provision that requires distributors (CEG and CEG Rio) to purchase all biomethane produced in the state — up to a limit of 10% of the total gas volume distributed, as follows:

- The concessionaire must launch a yearly public call for biomethane purchase proposals until the legal percentage is met;

- The distributor may also conduct multi-year proceedings;

- Once the purchasing mandate is met, the concessionaire must conduct new public procurement proceedings to maintain the proposed percentage.

- The procurement notice must be submitted for approval to the State Energy and Basic Sanitation Regulatory Agency (AGENERSA), which must respond within 30 days.

Find out more: New decrees by Claudio Castro regulate biomethane and fiscal incentives to thermal plants in Rio de Janeiro

OPORTUNITIES

| TYPE | DESCRIPTION | CONTRIBUTION TERM | CODE / NOTES |

| Petrobras Contracting | Chartering of AHTS-type vessel and specialized technical services. | September 30, 2025

12:00 PM |

7004345558 |

| Petrobras Contracting | Supply of FPSO-type Unit (SPU) and Pre-operation, Operation and Maintenance Services, in BOT mode, for SEAP II with the option of supplying an additional FPSO.

|

September 30, 2025

12:00 PM |

7004338481 |

| Petrobras Contracting | Supply of goods and services relating to revising and drafting the executive project, civil construction, electromechanical assembly, interconnections and commissioning including paving, drainage, temporary E.T.E., firefighting. | July 23, 2025

12:00 PM |

7004310036 |

| Petrobras Contracting | Supply of goods and services relating to revising and drafting the executive project, civil construction, electromechanical assembly, interconnections and commissioning of process, electricity, control, automation, telecommunications, and structures.

Supply of goods and services relating to revising and drafting the executive project, civil construction, electromechanical assembly, interconnections, and commissioning of the urea melt and granulation units. |

August 18, 2025

12:00 PM |

7004325327 |

| Petrobras Contracting | Chartering of fixed-wing aircraft – airplane – supporting the passenger and internal cargo transport operations in the Amazonas region. | July 18, 2025

05:00 PM |

7004427386 |

| Petrobras Contracting | “Chartering of up to two fixed-wing aircraft – airplane – to support passenger and internal cargo transport operations in the Amazonas region.” | July 18, 2025

05:00 PM |

7004426835 |

| Petrobras Contracting | Chartering of fixed-wing aircraft – airplane – supporting the passenger and internal cargo transport operations in the Amazonas region. | July 18, 2025

05:00 PM |

7004427673 |

| Petrobras Contracting | Chartering of SDSV-type vessel with water jet system and specialized services – Lots A and B1 – Brazilian flag. | July 31, 2025

08:00 PM |

7004370497 |

| Petrobras Contracting | Supply of goods and services relating to revising and drafting the executive project, civil construction, electromechanical assembly, interconnections and commissioning of the ammonia units and ammonia storage, including the SE-8252 power substation and control room.

|

August 18, 2025

12:00 PM |

7004325326 |

| Petrobras Contracting | Supply of goods and services relating to revising and drafting the executive project, civil construction, electromechanical assembly, interconnections and commissioning of the buildings, workshops, and laboratory, including the SE-48252 power substation and central facility.

|

August 18, 2025

12:00 PM |

7004324421 |

| Petrobras Contracting | Supply of goods and services relating to revising and drafting the executive project, civil construction, electromechanical assembly, interconnections and commissioning of the water treatment, effluent, and other utility systems, including the power substation and control building.

|

August 01, 2025

12:00 PM |

7004324662 |

| Petrobras Contracting | Supply of goods and services relating to revising and drafting the executive project, civil construction, electromechanical assembly, interconnections and commissioning of the power and steam generation systems, including the main substation.

|

August 18, 2025

12:00 PM |

7004324743 |

| Petrobras Contracting | Supply of goods and services relating to revising and drafting the executive project, civil construction, electromechanical assembly, interconnections and commissioning of the granular urea storage and handling systems.

|

August 18, 2025

12:00 PM |

7004324744 |

| Petrobras Contracting | Supply of goods and services relating to revising and drafting the executive project, civil construction, electromechanical assembly, interconnections and commissioning of the granular urea storage and handling systems.

|

August 01, 2025

12:00 PM |

7004324745 |

| Petrobras Contracting | Chartering of up to 14 PSV-type vessels.

|

July 25, 2025

05:00 PM |

7004439824 |

| Petrobras Contracting | P-86 – Supply of an FPSO Platform. | November 03, 2025

12:00 PM |

7004319880 |

| Petrobras Contracting | Supply of an FPSO-type stationary production unit (“UEP”), and pre-operation, operation, and maintenance services, in BOT mode, for the Albacora revitalization project.

|

October 01, 2025

12:00 PM |

7004415516 |

| Petrobras Contracting | Mooring and vessel connection services and subsea activities in buoy system frameworks and maritime facilities within the coverage area of the Aracaju Terminal.

|

September 12, 2025

12:00 PM |

7004303158 |

| Petrobras Contracting | LOT A: acquisition of three semi-refrigerated LPG vessels, with a capacity of 10,000 m³ – Class 79.

LOT B: acquisition of three pressurized LPG vessels with a capacity of 7,000 m³ – Class 78, and two pressurized LPG vessels with a capacity of 14,000 m³ – Class 84.

|

August 20, 2025

12:00 PM |

7004344317 |

| Petrobras Contracting | P-71 Subsea scale inhibitor and offshore tank lease.

|

July 22, 2025

05:00 PM |

7004453574 |

| Petrobras Contracting | Chartering of a fixed-wing aircraft – airplane – for transporting passengers and cargo across the equatorial margin.

|

July 24, 2025

05:00 PM |

7004446424 |

| Petrobras Contracting | Supply of goods and services relating to revising and drafting the executive project, civil construction, electromechanical assembly, interconnections and commissioning of process, electricity, control, automation, telecommunications, and structures of pipe/cable racks for the Nitrogen Fertilizer Unit UFN-III, located in the city of Três Lagoas, in the state of Mato Grosso do Sul. | July 23, 2025

12:00 PM |

7004324661 |

| Petrobras Contracting | GMP 6675-25 – Support Services for Contracting and Auditing Contracts in Information Technology and Telecommunications. | July 21, 2025

12:00 PM |

7004454936 |

| Petrobras Contracting | Chartering of up to six accommodation vessels and provision of offshore hospitality services. | July 23, 2025

05:00 PM |

7004478234 |

| Petrobras Contracting | Chartering of SDSV-type vessel with water jet system and specialized services – Lots A and B1 – Brazilian flag. | July 31, 2025

08:00 PM |

7004467077 |

| Petrobras Contracting | “Chartering of SDSV-type vessels and SDSVs with cargo handling systems and specialized services – LOTS B2 and B3 – Brazilian flag.” | July 31, 2025

08:00 PM |

7004467132 |

| Petrobras Contracting | “Chartering of SDSV-type vessel with cargo handling systems and specialized services – LOT B2 – Brazilian flag.” | July 31, 2025

08:00 PM |

7004467172 |

| Petrobras Contracting | Chartering of SDSV-type vessel and specialized services – LOT B3 – Foreign flag. | July 31, 2025

08:00 PM |

7004467208 |

| Petrobras Contracting | Chartering of up to three SOV-type vessels and provision of maritime hospitality services. | July 18, 2025

05:00 PM |

7004460732 |

| Petrobras Contracting | P-71 Subsea scale inhibitor and offshore tank lease. | July 22, 2025

05:00 PM |

7004453574 |

| Call for Contributions (“TS”) (ANEEL) | |||

| TS 007/2025 | Obtain contributions for the Minimum Viable Product of the Practical Guide on Climate Change and Energy Transition. | Until August 04, 2025 | |

| Public Consultations (ANEEL) | |||

|

CP 025/2025 |

Obtain contributions for improving the draft notice and respective annexes of Auctions No. 5/2025-ANEEL, No. 6/2025-ANEEL, and No. 7/2025-ANEEL, referred to respectively as the 2025 ‘A-1’, ‘A-2’, and ‘A-3’ Existing Energy Auctions, which are intended for the purchase of electricity from existing generation facilities. |

Until August 04, 2025 | |

|

Public Consultations (MME) |

|||

| CP 187/2025 | Proposed guidelines for applying discounts on electricity transmission and distribution usage tariffs. | July 24, 2025 | |

**

** Please note that the deadlines in the table above are constantly changing, so the information mentioned above corresponds to deadlines published at the time of publication of this newsletter.

WHAT´S NEXT

| August 22, 2025 – New Energy Auctions A-5

More information here. |

| September 2025 – Auction for the Supply of Isolated Systems

More information here. |

| October 31, 2025 – Transmission Auction No. 004/ 2025 – ANEEL

More information here. |

| December 14, 2025 – New Energy Auctions A-1, A-2, and A-3

More information here. |

| April 2026 – Transmission Auction 001/2026

To be held by ANEEL. |

| October 2026 – Transmission Auction 002/2026

To be held by ANEEL. |

| April 2027 – Transmission Auction 001/2027

To be held by ANEEL. |

| October 2027 – Transmission Auction 002/2027

To be held by ANEEL. |

Related Partners

Related Lawyers

Arthur Azerêdo Alencar Feitosa

Arthur de Salvo Plotz

Bianca Reis

Gabriela Stockhausenn Vignon Gomes

João Raphael Oliveira Aranha

Lívia Sousa Borges Leal

Luis Eduardo Ribeiro

Roberta Coelho de Souza Batalha

Thais Araujo Rato Tarelho

Barbara Fornielles

Related Areas

Energy and Natural Resources Oil and Gas